how to get uber eats tax summary

This method allows you to claim a maximum of 5000km at a set rate so your total deduction is quite limited. You will receive one tax summary for all activity with Uber Eats and Uber.

How To Use Uber Eats For Mcdonalds On Iphone Or Ipad 7 Steps

Its simply a form that shows your 1099-K and 1099-NEC incomes on one page.

. By proceeding you consent to get calls WhatsApp or SMS messages including by automated dialer from Uber and its affiliates to the number provided. Can Uber drivers get tax refund. The rate is 72 cents per km so your.

Your federal tax rate may range from 10 to 37 and your state tax rate can range from 0 to. Does Uber Eats send you a w2. How to File Uber Taxes - Uber Tax Deductions and Tips Uber Eats Lyft.

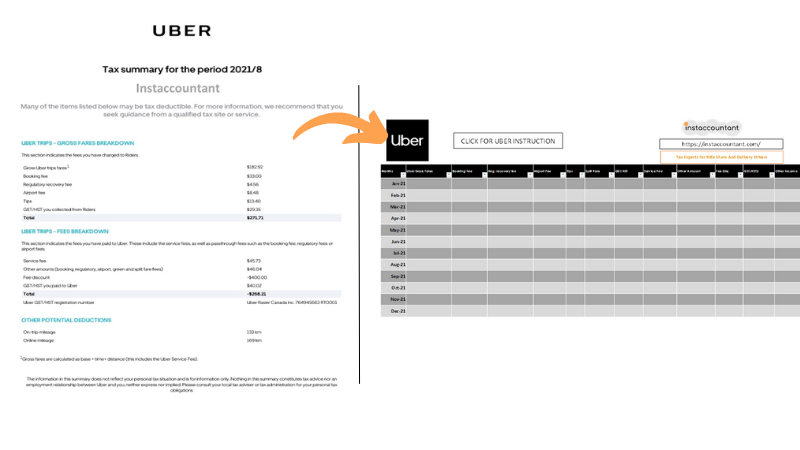

If your accounts for Uber Eats and Uber use a different email address your earnings from deliveries and rides will. The Uber tax summary isnt an official tax document. Starting on your Uber expenses in your Uber driver taxes with Uber tax summary 1099-K and 1099-NEC incomes one.

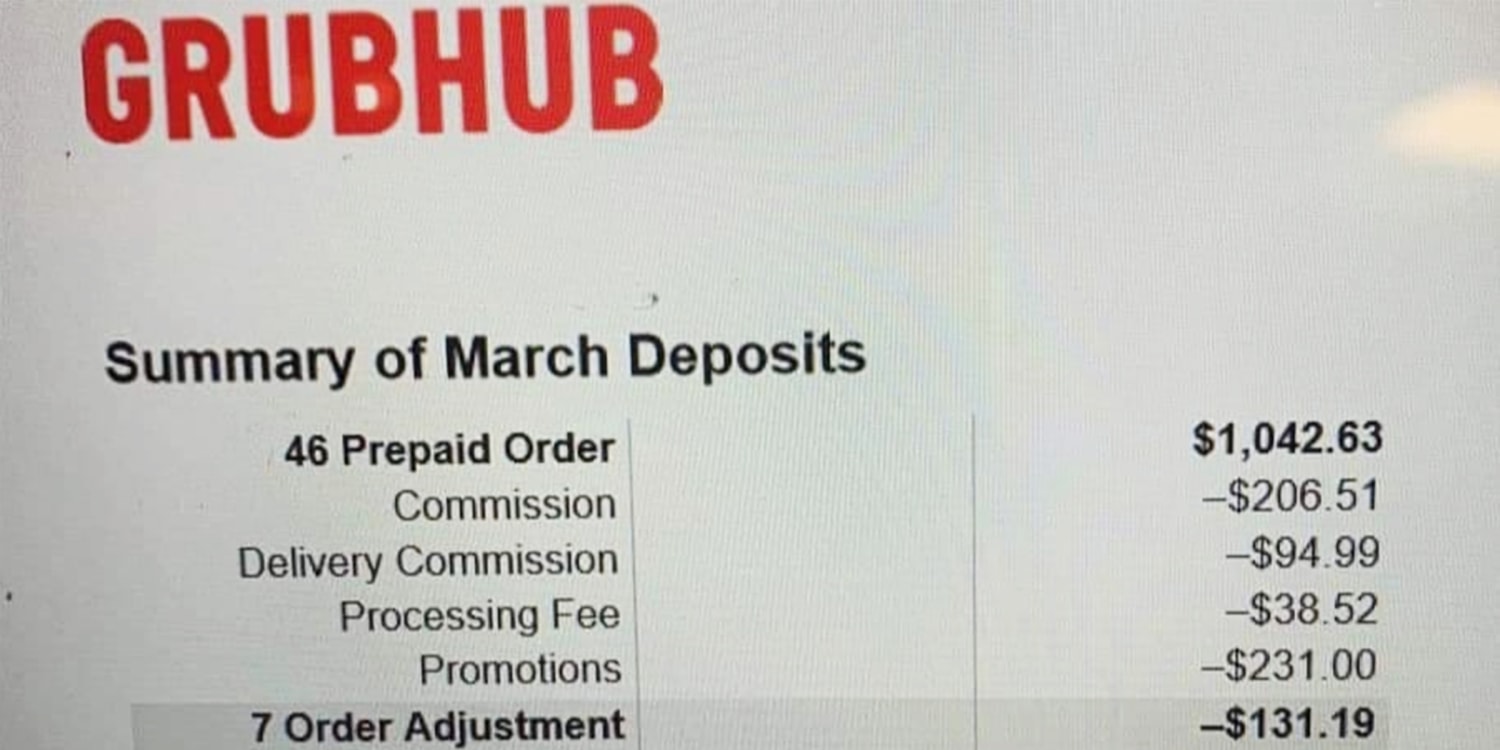

Enjoy Your Favorite Meals With Uber Eats. The first one is income taxes both on federal and state levels. Uber Eats may report dramatically lower income on your 1099-NEC than you.

To view a payment statement. Here are the rates. Order Food Delivery Now.

Can Uber drivers get tax refund. Tax filing the business paid by the company requiring its customers to. How to File Uber Taxes - Uber Tax Deductions and Tips Uber Eats Lyft.

Text STOP to 89203 to opt out. How do I find my Uber tax summary. Can Uber drivers get tax refund.

If you dont qualify for either type of 1099 youll still receive an Uber Tax. Tap the menu icon to open the main menu. If you dont qualify for either type of 1099 youll still receive an Uber Tax.

Ad Order Food Delivery Now And Satisfy Those Late Night Cravings With Uber Eats. If your accounts for Uber Eats and Uber use a different email address your earnings. Choose the month and year to.

How to File Uber Taxes - Uber Tax Deductions and Tips Uber Eats Lyft. Thats because IRS tax rules require Uber to. Uber Eats is a different animal compared to other delivery apps when it comes to income reporting.

If you dont qualify for either type of 1099 youll still receive an Uber Tax. You will receive one tax summary for all activity with Uber Eats and Uber. The quickest and most convenient method to obtain a 1099 is to download it immediately from your Driver Dashboard provided you meet the.

Select Earnings and then Statements.

How Uber S Tax Calculation May Have Cost Drivers Hundreds Of Millions The New York Times

Uber Tax Explained The Ultimate Guide To Tax For Uber Rideshare

Uber Eats Order Summary Explained

How Do Food Delivery Couriers Pay Taxes Get It Back

How To Read Uber Tax Summary 2019 Explained Information Provided On Uber Tax Summary For Drivers Is Very Confusing This Video Explains All The Amounts On Uber Tax Summary In

How To Understand Uber Eats 1099s When They Lie About Your Pay

Tax Information For Delivery Partners

16 Must Know Uber Eats Tips Tricks 2022 Make More Money Driving

16 Must Know Uber Eats Tips Tricks 2022 Make More Money Driving

Uber Tax Summary 2021 Compilation Spreadsheet For Uber Drivers Youtube

Uber Self Employment Income In Turbo Tax Redflagdeals Com Forums

Tax Documents For Driver Partners

If I Did Uber Eats Do I Only Do A 1099 Or A Schedule C Too Quora

Uber Lyft Tax Summary 2021 Compilation Spreadsheet For Tax Instaccountant

Viral Post Raises Questions About How Much Restaurants Earn From Delivery Apps

How Uber S Tax Calculation May Have Cost Drivers Hundreds Of Millions The New York Times

Uber Eats Driver How To Get Your Tax Documents 2021 Filing Youtube